There are several new regulations and laws that will be implemented at both the federal and provincial levels throughout Canada this year. These changes are expected to impact international students, temporary foreign workers, and permanent residents throughout the country.

Federal tax rules are changing, including an increase in the annual contribution limit for Tax-Free Savings Accounts (TFSA) and the maximum contribution for Registered Retirement Savings Plans (RRSP). The Canada Pension Plan (CPP) and Employment Insurance (EI) also have increased contributions for workers in 2024.

The federal carbon tax is increasing as well, which will impact the cost of gasoline and household expenses for Canadian residents. Additionally, new financial requirements for international students will double the cost of living financial requirement that applicants must display during the application process.

At the provincial level, there are changes expected in Ontario, Quebec, Prince Edward Island, Nova Scotia, Northwest Territories, and Nunavut. These changes range from minimum wage increases to licensing procedures for employment agencies and updates to health benefits for low-income residents.

These upcoming changes are significant, and it’s important for newcomers to be aware of how they might be affected by these new regulations. For anyone considering Canadian immigration, it’s crucial to stay informed about these changes and how they might impact your transition to life in Canada.

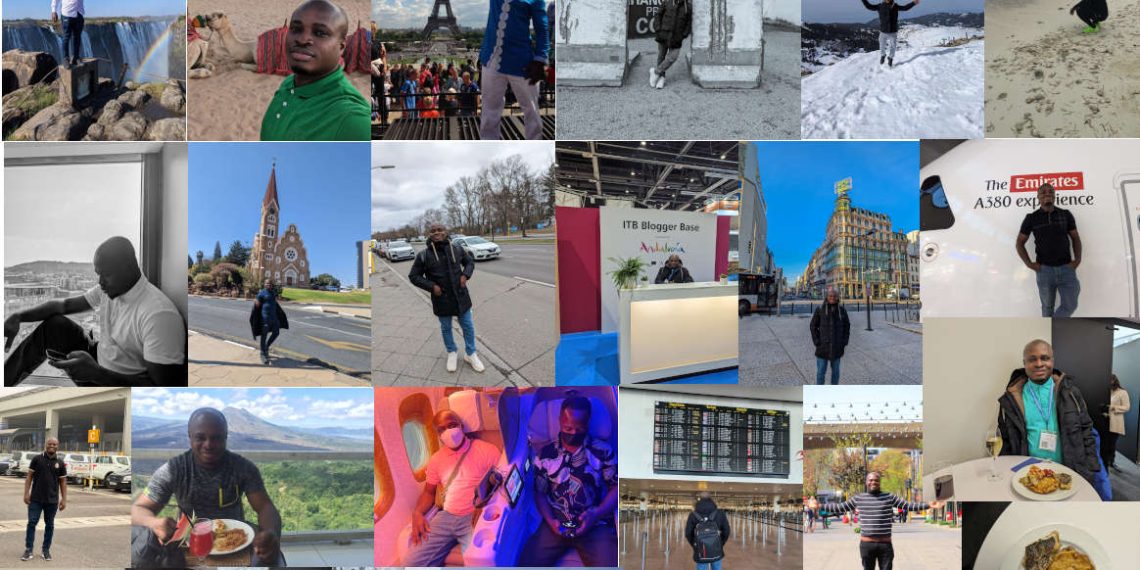

Still have some travel questions? Ask in our Travel WhatsApp Group.